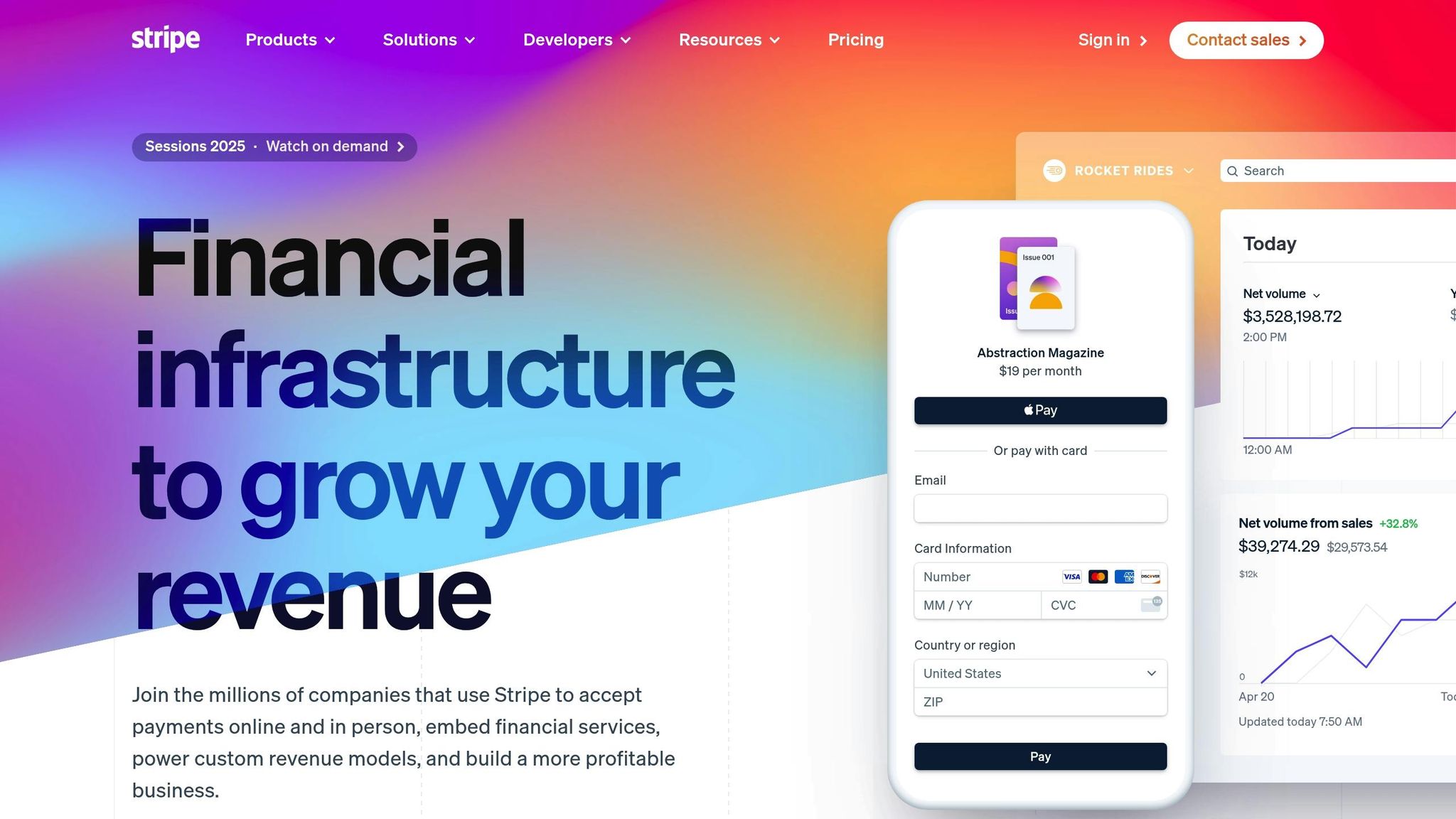

Recurring Payments with Stripe: Setup Guide

Setting up recurring payments for your job board using Stripe can transform your platform into a consistent revenue generator. This guide walks you through the process, from creating a Stripe account to configuring subscription plans and ensuring compliance with U.S. regulations. Here’s a quick summary of what you’ll learn:

- Stripe Basics: How to create and verify your account, link a bank account, and meet tax/legal requirements.

- Subscription Setup: Steps to create subscription products, configure payment schedules, and use Stripe tools like Billing, Checkout Sessions, and Payment Links.

- Customer Experience: Tips to set up a customer portal, automate notifications, and manage billing transparency.

- Compliance: Key regulations to follow, including auto-renewal disclosures, tax handling, and data security.

With Stripe’s integration on Job Boardly, you can easily manage employer memberships, premium job listings, and more without technical expertise. This guide ensures your setup is smooth, secure, and user-friendly.

How to Accept Stripe Recurring Subscription Payments in WordPress

Prerequisites for Stripe Setup

Getting everything in place beforehand is key to making sure your recurring billing system runs smoothly.

Create and Verify Your Stripe Account

Start by creating a Stripe account and completing the required business verification process. Stripe needs detailed information about your business to comply with financial regulations and reduce the risk of fraud.

Head over to stripe.com and sign up using your business email. You'll need to provide key business details during the registration process. Be prepared for verification to take a few days, as Stripe may request additional documents to confirm your information.

You'll also need to link your business bank account to receive payouts. Stripe typically processes ACH transfers in about two business days. For quicker access to funds, you can enable Express payouts, though this service usually comes with an extra fee.

Make sure your business name is consistent across all documents to avoid delays in the verification process. Once your account is verified, you can move forward with meeting U.S. tax and legal requirements.

U.S. Tax and Legal Requirements

Complying with state-specific tax and legal regulations is crucial. In some states, subscription software services are subject to sales tax, and these rules can change over time.

Your subscription terms should clearly outline important details like billing frequency, cancellation policies, and refund procedures. Regulations require that recurring charges be displayed transparently before customers make a purchase. For example, instead of just listing "$99", specify "$99/month, billed monthly."

Additionally, some states have auto-renewal laws that mandate specific wording in your terms of service. These may include clear cancellation instructions and renewal reminders. If your job board operates in industries with stricter regulations, consider consulting a business attorney who specializes in subscription billing.

Secure Payment Processing Setup

Stripe simplifies PCI DSS compliance by using hosted forms, but you’ll still need to complete their annual security questionnaire. This confirms that your handling of cardholder data meets current standards and ensures your Job Boardly integration remains secure.

For added protection, enable 3D Secure for high-value or international transactions to reduce the risk of chargebacks. Stripe’s Radar fraud prevention system is active by default, but you can customize its rules to better fit your needs.

During setup, configure webhook endpoints so Stripe can notify Job Boardly about subscription events like creations, updates, or cancellations. This ensures that customer access aligns with payment changes in real time.

Finally, use Stripe’s test mode to simulate different scenarios, such as successful transactions and payment failures. This step helps confirm that Job Boardly responds correctly to all payment updates.

Once your payment system is secure, you’re ready to move on to setting up recurring payments.

Setting Up Recurring Payments in Stripe

Once your Stripe account is verified and the necessary security measures are in place, you’re ready to set up recurring payments. Stripe offers three main ways to manage subscriptions, and the best option depends on your job board's needs. Let’s break them down.

Using Stripe Billing for Subscriptions

Stripe Billing is a robust tool for managing subscriptions. To get started, head to the Products section in your Stripe dashboard and create your first subscription product. Click Add product, then fill in the service name, description, and pricing details.

When setting up pricing, you can choose between standard pricing (ideal for simple monthly or yearly plans) or usage-based pricing (for more complex billing). For most job boards, standard pricing works well. For example, you might set a monthly fee of $49.00 and select a billing interval that fits your model.

Consider offering a trial period to encourage signups. A 14-day free trial is a popular choice, but the trial length should match the time it typically takes for employers to see value in your job board. Strike a balance between creating urgency and giving users enough time to evaluate your service.

Enable proration for smooth billing when customers switch plans. This minimizes confusion and keeps the experience seamless.

Once your product is ready, you can explore how Stripe’s pre-built Checkout Sessions can further simplify the subscription process.

Setting Up Stripe Checkout Sessions

Stripe Checkout offers fully designed, mobile-friendly payment forms that handle subscription signups with ease. These forms support various payment methods, including credit cards, digital wallets, and bank transfers.

To set up a Checkout session, you’ll need to define subscription products (line items), set success and cancel URLs, and configure customer data collection. The success URL should guide users to a welcome page or dashboard, while the cancel URL can redirect them to your pricing page.

Enable email collection during checkout to maintain communication with subscribers. If needed, collect billing addresses for tax compliance, but avoid asking for unnecessary details to keep the process simple.

You can also enable the allow promotion codes feature for discounts. Create promotion codes in your Stripe dashboard, and customers can use them during checkout. This is perfect for launch offers, referral discounts, or seasonal campaigns.

For job boards with multiple subscription tiers, use the quantity adjustment feature cautiously. It works well for seat-based pricing (like multi-user accounts), but it may confuse customers if your subscriptions don’t involve variable quantities.

Finally, consider enabling Stripe Tax to handle sales tax calculations automatically. This is especially useful if your business operates in states with varying tax requirements.

If you’re looking for an even simpler solution, Stripe’s Payment Links might be the way to go.

Creating Payment Links for Subscriptions

Payment Links are the easiest way to sell subscriptions without writing a single line of code. These shareable URLs take customers to Stripe-hosted checkout pages, making them ideal for email campaigns, social media, or direct sales.

To create a Payment Link, select your subscription product and customize the checkout experience. You can add your logo, adjust colors to match your brand, and include personalized messaging on the payment page.

For added professionalism, set up a custom domain (like payments.yourjobboard.com) by adding a CNAME record to your DNS settings. This small step boosts trust and can improve conversion rates compared to using generic Stripe URLs.

Use the quantity limits feature to prevent users from accidentally purchasing multiple subscriptions. For standard job board plans, set the maximum quantity to 1 unless you offer multi-user or multi-location pricing.

Payment Links also simplify subscription management. After making a purchase, customers receive emails with links to update payment methods, download invoices, or cancel subscriptions. This self-service approach reduces support requests while giving users more control.

For tracking performance, Payment Links support analytics tracking. Add UTM parameters to your links (e.g., ?utm_source=email&utm_campaign=launch) to measure which channels drive the most subscriptions.

You can even create multiple Payment Links for the same product, each with different messaging or promotional codes. This allows you to test different approaches or target specific customer segments with tailored offers.

Creating Subscription Plans and Payment Schedules

Design subscription plans that match your pricing strategy and cater to your customer base effectively.

Building Subscription Products

Start by defining three core subscription tiers in Stripe's Products section: "Startup Recruiter" ($29.00/month), "Growing Business" ($79.00/month), and "Enterprise Solutions" ($199.00/month).

When naming your plans, choose labels that clearly communicate value. Avoid generic names like "Plan A" or "Silver." Instead, use descriptive titles that help customers quickly identify which option suits their needs.

Set billing intervals based on what works best for your customers and your business. Monthly billing appeals to customers seeking flexibility, while annual billing often boosts retention and improves cash flow. Offering a discount - typically 15–20% off the monthly rate - for annual commitments can encourage customers to choose longer-term plans.

If your business model includes usage-based pricing, Stripe’s metered billing feature is a great option. For example, job boards can charge per job posting or per application received. Stripe can automatically track and bill these activities through usage records.

Tiered pricing is another flexible approach. For instance, you could charge $2.00 per job posting for the first 10 posts, $1.50 for posts 11–50, and $1.00 for any additional posts. This structure rewards higher usage while keeping costs manageable for smaller customers.

Don’t forget to set tax rules for each product. In the U.S., many software subscriptions are subject to sales tax in states where you have nexus. Stripe Tax can automate these calculations, but you’ll need to specify whether your products are taxable.

Once your product tiers are set, fine-tune the billing intervals and payment options to align with customer preferences.

Setting Up Flexible Payment Schedules

Stripe offers more than just monthly and annual billing. You can create custom billing intervals, such as quarterly or weekly. Quarterly billing strikes a balance between flexibility and commitment, while weekly billing might suit high-volume recruiters who prefer smaller, frequent payments.

To lower the financial barrier for customers, consider installment plans. For example, instead of charging $1,200 upfront for an annual plan, you could offer four quarterly payments of $300. This makes the cost more manageable while still securing a long-term commitment.

If your business experiences seasonal demand, Stripe’s pause and resume functionality can be a lifesaver. For instance, job boards serving industries like summer camps or holiday retail can pause subscriptions during off-seasons and resume them when activity picks up.

Enable immediate proration for plan upgrades so customers can switch seamlessly without overpaying. For downgrades, apply changes at the end of the billing cycle to avoid refund complications.

Set up grace periods for failed payments to reduce involuntary cancellations. A 3–7 day grace period allows customers to update expired cards while keeping their service uninterrupted. This small adjustment can significantly recover failed payments.

Once your products and schedules are ready, ensure pricing, renewal dates, and cancellation terms are communicated clearly to build trust with your customers.

Transparency and Compliance Best Practices

Transparency is key. Display all fees upfront, including setup costs, processing fees, and any extra charges for premium features. Use clear date formats like MM/DD/YYYY when stating renewal dates: "Your subscription renews on 03/15/2026."

Send renewal reminders 7 days and 24 hours before billing. Include essential details like the amount to be charged (e.g., $79.00), the payment method (e.g., card ending in 1234), and the service period (e.g., 03/15/2026–04/14/2026). This level of detail helps reduce surprise cancellations and builds customer confidence.

For cancellation policies, be specific about access after cancellation. For example, many job boards allow users to retain access until the end of their billing period, which feels fairer and helps prevent negative feedback.

Refund policies should also be clear. A common method is to offer full refunds within 30 days of the initial purchase, with prorated refunds for annual subscriptions canceled within the first 90 days. These policies should be documented in your terms of service and customer communications.

Include legally required auto-renewal disclosures in your checkout flow and confirmation emails. For instance: "This subscription automatically renews every month/year unless canceled." In some U.S. states, this disclosure must be prominently displayed.

When adjusting pricing, notify customers at least 30 days in advance. To maintain goodwill, you could offer existing customers the option to lock in their current rate for a set period or switch to annual billing at the previous rate.

Finally, keep detailed billing records for tax and compliance purposes. While Stripe generates invoices with all necessary details, make sure your customer portal allows users to easily view payment history, tax documents, and subscription details. This level of transparency meets customer expectations and ensures compliance with regulations.

sbb-itb-316a34c

Managing Customer Experience and Compliance

Once you've set up recurring payments, the next step is to refine customer interactions while staying compliant with U.S. regulations. A smooth customer experience can minimize support requests, while compliance ensures your business avoids legal pitfalls. Striking a balance between user-friendly self-service options and transparent communication is key.

Setting Up a Customer Portal

Stripe's Customer Portal can be a game-changer for subscription management. It allows customers to handle tasks like updating payment methods, managing subscriptions, and viewing billing history - all without needing to contact support. Customizing the portal to align with your branding helps build trust and ensures a seamless experience.

Here are a few essential features to consider:

- Plan Changes: Let customers upgrade their plans instantly with prorated charges or schedule downgrades to take effect at the end of their billing cycle.

- Payment Method Updates: Enable users to add new cards, update expiration dates, or set a default payment method with ease, reducing the chance of failed transactions.

- Billing History: Include a section where customers can download invoices and receipts. These should clearly display your business name, address, tax ID, and a breakdown of charges.

- Cancellation Options: Create a simple cancellation flow that gathers feedback with prompts like "Why are you canceling?" Options such as "Too expensive", "Not using it enough", or "Missing features" can provide valuable insights. Offering an option to pause subscriptions rather than cancel outright can also be a helpful alternative for customers facing temporary financial challenges.

Automating Notifications and Renewals

Automated notifications are crucial for keeping customers informed and reducing churn. Set up email sequences that trigger at key moments in the subscription cycle:

- Payment Confirmations: Send immediate emails detailing the charge, billing period, and renewal date.

- Renewal Reminders: Notify customers at intervals such as one week and 24 hours before their subscription renews, giving them time to review or adjust their plans.

- Failed Payment Alerts: If a payment fails, send clear instructions on how to update payment details. Use smart retry logic, like attempting charges at different times of the day, to improve the chances of successful transactions.

- Welcome Sequences: For new subscribers, send a confirmation email followed by an onboarding message that highlights key features and provides login instructions. This can improve the initial experience and set the tone for a positive relationship.

These automated processes can make your recurring payment system feel effortless and reliable for your customers.

U.S. Regulations Compliance

Compliance with U.S. consumer protection laws isn't just about avoiding legal trouble - it also builds trust with your customers. Here are some key areas to focus on:

- Clear Auto-Renewal Language: Use straightforward language like, "This subscription automatically renews each billing cycle unless you cancel. You can cancel anytime through your account settings or by contacting support."

- Accessible Cancellation: Ensure that canceling a subscription is as simple as signing up for one.

- Data Security: Use SSL, secure hosting, and limit access to sensitive data.

- Sales Tax Management: Tools like Stripe Tax can help you apply the correct sales tax and register in states where you meet economic nexus thresholds.

- Refund Policies: Clearly define refund conditions, such as offering full refunds within a set period or prorated refunds for longer billing cycles.

- Recordkeeping: Maintain detailed records of transactions, tax documents, customer communications, terms of service, and policy updates for several years, as required by state laws.

- ADA Compliance: Ensure your portal and billing pages meet accessibility standards with features like alt text, keyboard navigation, and sufficient color contrast.

- State-Specific Rules: Address unique requirements, such as California's Automatic Renewal Law, by including necessary disclosures and obtaining explicit consent for auto-renewals during checkout.

Stay on top of regulatory updates and consult legal experts regularly to ensure compliance remains a core part of your operations. This proactive approach not only protects your business but also strengthens your relationship with customers.

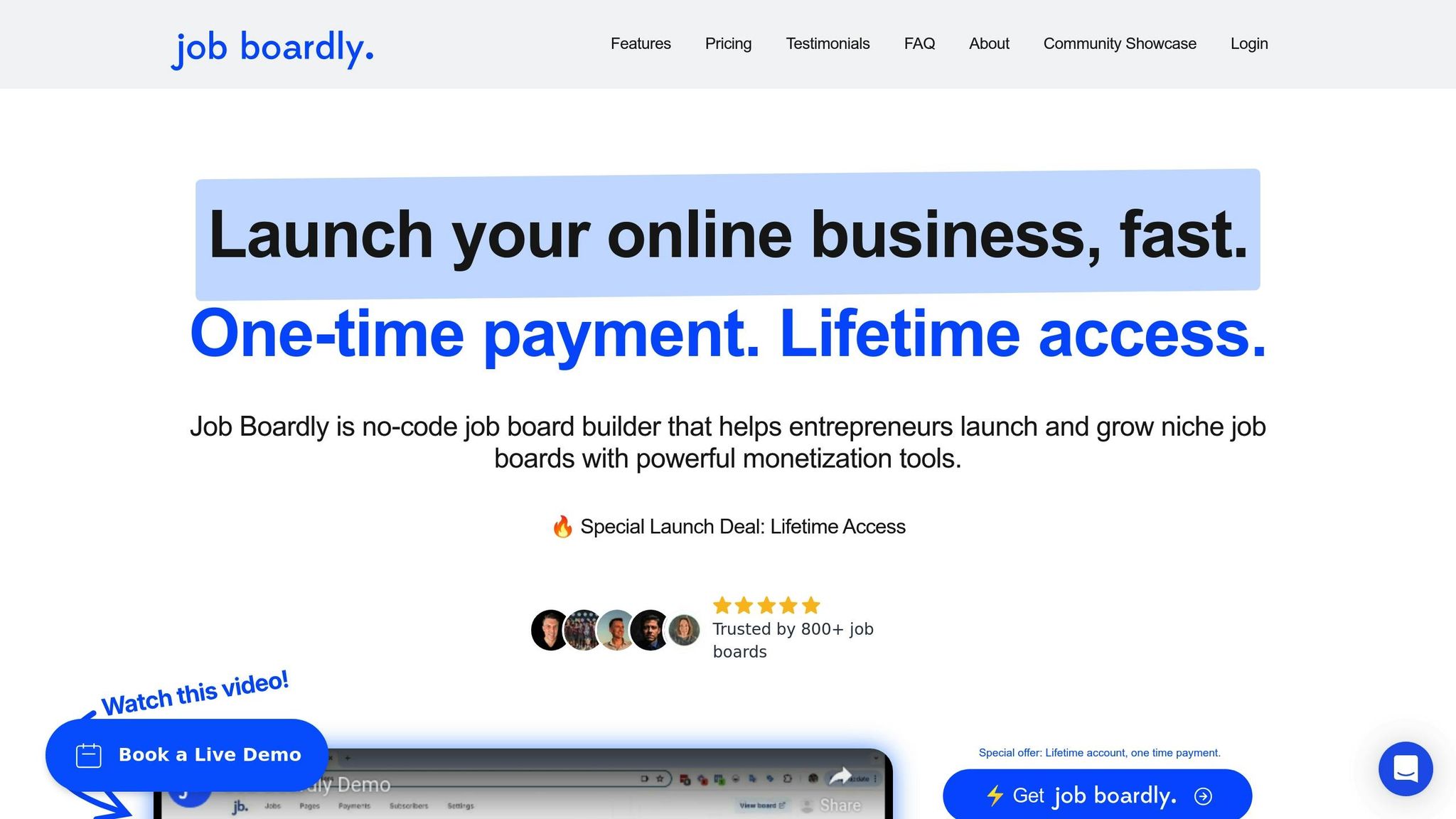

Integrating Stripe with Job Boardly

Once your Stripe account is set up and you've planned your recurring payment strategies, linking it to your job board through Job Boardly can help you generate consistent revenue. The integration is simple and doesn't require any coding skills, making it accessible for anyone looking to monetize their platform. Here's how you can seamlessly incorporate Stripe into your Job Boardly setup.

Setting Up Stripe in Job Boardly

Job Boardly comes with a built-in Stripe integration that connects your platform to Stripe Checkout. This allows for secure payments and flexible pricing options for various job post types, like basic, promoted, or featured listings. If you're offering recurring payment plans, Stripe's Payment Links make it easy to support employer memberships or premium subscriptions. To get started, head to the payment settings in your Job Boardly dashboard and input your Stripe publishable and secret keys to complete the authentication process.

Leveraging Job Boardly Features for Revenue Growth

Once Stripe is integrated, Job Boardly provides a suite of tools to help you maximize your earning potential. For instance, its paywall feature lets you create membership tiers, enabling employers to pay monthly or annually for perks like enhanced posting privileges or access to premium features. Additionally, the platform's multi-language support ensures you can reach a global audience effectively.

To keep your job board dynamic and appealing, features like Turbo Backfiller and Magic Aggregator automatically populate your site with relevant job listings. This adds value to your subscription plans and keeps your content fresh. Built-in SEO tools and Google Jobs integration further boost your board’s visibility, helping you attract more organic traffic.

Custom domains and branding options enhance credibility, making your platform more appealing to potential subscribers. You can also use Stripe’s promotional features, like coupon codes, to offer discounts on subscription plans. For niche job boards, the customizable job categories feature allows you to create subscription tiers tailored to specific industries or regions, giving you even more flexibility to cater to your audience.

Conclusion

Using Stripe for recurring payments can simplify your job board's operations while creating a steady revenue stream. By setting up a Stripe account, defining subscription products, and selecting the right checkout method, you can build a system that’s both efficient and user-friendly.

Focusing on customer experience is essential. With Stripe’s Customer Portal, subscribers can manage their billing independently, reducing the need for support and giving them more control. Automated email reminders for renewals, payment confirmations, and failed payments further enhance the experience, keeping customers informed and reducing churn.

Transparency is another critical factor. Display clear pricing, billing intervals, and cancellation policies in your subscription settings to ensure compliance and build trust. Activating revenue recovery tools, like smart retries and dunning emails, can also help recover failed payments automatically, minimizing lost revenue.

For Job Boardly users, the built-in Stripe integration takes care of the technical setup, letting you focus on growing your business. Whether it’s monthly employer memberships, premium job posting packages, or tiered feature access, the integration ensures a seamless experience for both you and your customers.

Before launching, it’s important to test scenarios like new subscriptions, trial transitions, failed payments, and plan changes. Keep an eye on key metrics such as trial-to-paid conversion rates, involuntary churn, and recovery rates from dunning processes. These insights will help you fine-tune your recurring billing system for maximum efficiency and customer satisfaction.

FAQs

What should I know about U.S. tax and legal compliance when setting up recurring payments on Stripe?

Ensuring Compliance with U.S. Tax and Legal Requirements on Stripe

When setting up recurring payments on Stripe, staying compliant with U.S. tax and legal regulations is crucial. Here are a few areas to focus on:

- Sales Tax: Make sure you calculate and collect sales tax correctly based on your customer's location. Tools like Stripe Tax can simplify this by automating the process for you.

- Customer Consent: Always secure clear and explicit consent from your customers for recurring charges. This includes adhering to legal standards for storing and using payment details.

- IRS Reporting: Don’t overlook IRS requirements. For instance, you’ll need to issue Form 1099-K for payments that exceed $600 within a calendar year.

By keeping these points in check, you can handle recurring payments efficiently while staying within the bounds of U.S. laws and regulations.

How can I use Stripe to improve the customer experience and reduce churn for my job board's subscription service?

Stripe makes it easier to improve the customer experience and keep churn rates low by providing tools designed to simplify subscription management and billing. With a self-service portal, customers can handle their subscriptions independently, while features like automated invoicing and flexible billing options - such as pauses or trial extensions - add a layer of convenience.

To tackle involuntary churn, Stripe takes proactive steps like automatically retrying failed payments and sending timely notifications to customers about payment issues. These features, paired with a smooth payment process, help establish trust and foster long-term loyalty for your job board's subscription service.

How can I test and optimize my Stripe recurring payment setup before launching it on my job board?

To make sure your Stripe recurring payment setup runs smoothly, start by diving into Stripe's test environment. Create sample subscriptions and mimic real-world scenarios like free trials, payment failures, and subscription renewals. This allows you to double-check the billing process. You can also use test clocks to validate trial periods and ensure invoices are generated correctly.

Once you've tested internally, gather feedback through user testing in a controlled setting. This helps uncover any hiccups in the payment flow. Don’t forget to fine-tune retry and dunning settings to manage failed payments efficiently. These steps will set you up for a seamless launch of your recurring payments system.